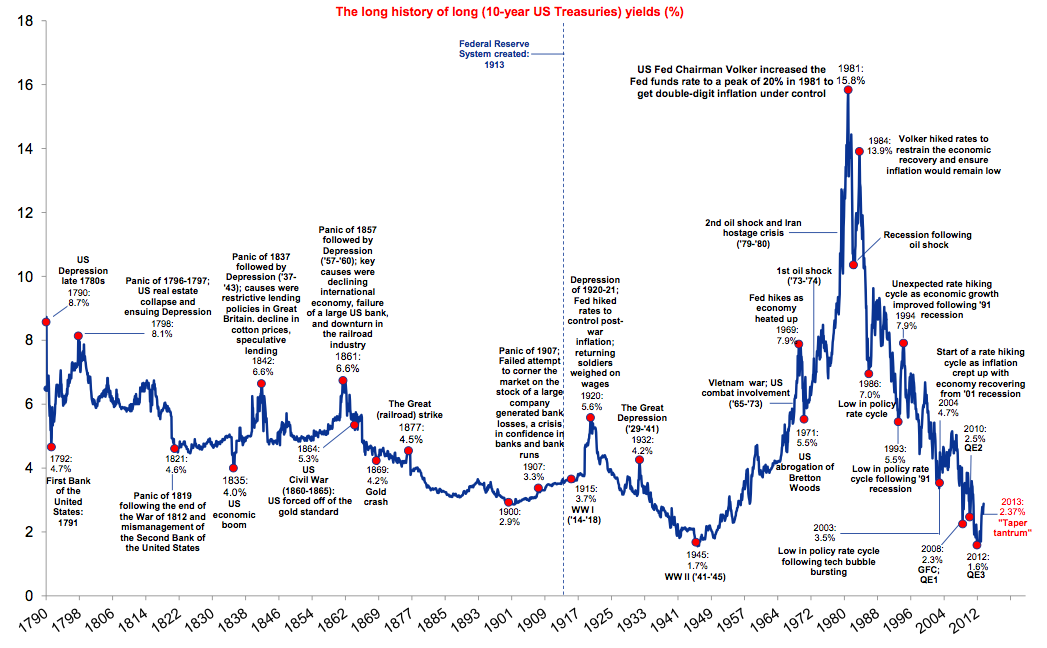

Historical look at US interest rates

For those interested at a look at historical interest rates and where we may go from here?

http://www.ritholtz.com/blog/wp-content/uploads/2013/12/Screen-shot-2013-12-22-at-9.50.39-AM.png

Why look at interest rates for future guidance on the stock market? An interesting point made by Buffett in 1999:

"look at one of the two important variables that affect investment results: interest rates. These act on financial valuations the way gravity acts on matter: The higher the rate, the greater the downward pull. That's because the rates of return that investors need from any kind of investment are directly tied to the risk-free rate that they can earn from government securities. So if the government rate rises, the prices of all other investments must adjust downward, to a level that brings their expected rates of return into line. Conversely, if government interest rates fall, the move pushes the prices of all other investments upward. The basic proposition is this: What an investor should pay today for a dollar to be received tomorrow can only be determined by first looking at the risk-free interest rate.

Consequently, every time the risk-free rate moves by one basis point--by 0.01%--the value of every investment in the country changes. People can see this easily in the case of bonds, whose value is normally affected only by interest rates. In the case of equities or real estate or farms or whatever, other very important variables are almost always at work, and that means the effect of interest rate changes is usually obscured. Nonetheless, the effect--like the invisible pull of gravity--is constantly there."

No comments:

Post a Comment