Friday 4 July 2014

Charlie Munger early life

Wednesday 14 May 2014

Great article from Base Hit Investing

Friday 2 May 2014

Value thoughts from Lauren Templeton, Jesse Livermore, Wilbur Ross

Saturday 19 April 2014

Old article about notable value investors

Saturday 29 March 2014

Amazon on 60 Minutes

Jeff Matthews on Carl Icahn & Ebay

Taleb & Warren Buffett

Robert Schiller says don't write off Italy

Friday 28 March 2014

David Winters of Wintergreen Advisers: 2014 March

http://youtu.be/x6I1B3MaTms

Monaco documentary by Piers Morgan

P&C insurance combined ratio and ROE

Thursday 27 March 2014

Thoughts on 'Baby Berkshire'

Why large caps at this time?

Security analysis notes

…It must be remembered that the automatic or normal economic forces militate against the indefinite continuance of a given trend…

…diminishing returns, etc., are powerful foes to unlimited expansion, and in smaller degree opposite elements may operate to check a continued decline. Hence instead of taking the maintenance of a favorable trend for granted—as the stock market is wont to do—the analyst must approach the matter with caution, seeking to determine the causes of the superior showing and to weigh the specific elements of strength in the company’s position against the general obstacles in the way of continued growth.

In particular here was an interesting line by Graham & Dodd about PE Ratio:

...As we shall point out in the next chapter, this assumed earning power may properly be capitalized more liberally when the prospects appear excellent than in the ordinary case, but we shall also suggest that the maximum multiplier be held to a conservative figure (say, 20, under the conditions of 1940) if the valuation reached is to be kept within strictly investment limits. On this basis, assuming that general business conditions in the current year are not unusually good, the earning power of Company A might be taken at $7 per share, and its investment value might be set as high as[…]

Friday 10 January 2014

Goverment bonds defaults

For those looking at getting higher returns from foreign government bonds, here are some wise words from Benjamin Graham below. Graham talks about the reliability of private bonds vs government bonds in Intelligent Investor.

“Bonds of Foreign Corporations. In theory, bonds of a corporation, however prosperous, cannot enjoy better security than the obligations of the country in which the corporation is located. The government, through its taxing power, has an unlimited prior claim upon the assets and earnings of the business; in other words, it can take the property away from the private bondholder and utilize it to discharge the national debt. But in actuality, distinct limits are imposed by political expediency upon the exercise of the taxing power. Accordingly we find instances of corporations meeting their dollar obligations even when their government is in default.” Excerpt From: Graham, Benjamin. “Security Analysis.” McGraw-Hill, 2009.

List of sovereign debt defaults: http://en.wikipedia.org/wiki/List_of_sovereign_debt_crises

More Intelligent Investor quotes:

“I. Safety is measured not by specific lien or other contractual rights, but by the ability of the issuer to meet all of its obligations.3

II. This ability should be measured under conditions of depression rather than prosperity.

III. Deficient safety cannot be compensated for by an abnormally high coupon rate.

IV. The selection of all bonds for investment should be subject to rules of exclusion and to specific quantitative tests corresponding to those prescribed by statute to govern investments of savings banks.”

Excerpt From: Graham, Benjamin. “Security Analysis.” McGraw-Hill, 2009.

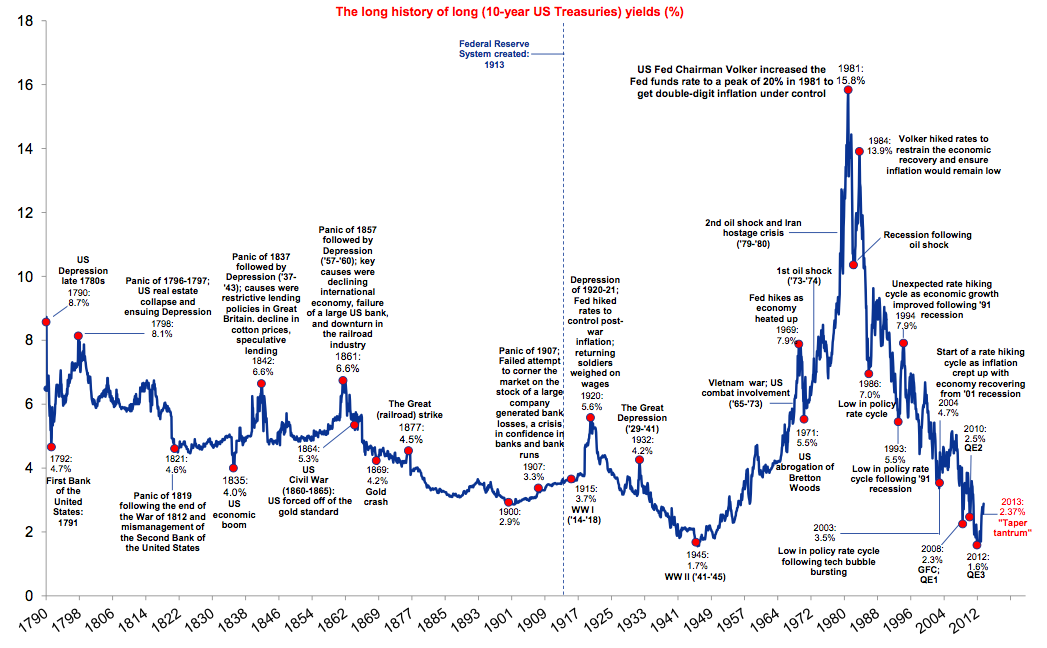

Historical look at US interest rates

Historical look at US interest rates

For those interested at a look at historical interest rates and where we may go from here?

http://www.ritholtz.com/blog/wp-content/uploads/2013/12/Screen-shot-2013-12-22-at-9.50.39-AM.png

Why look at interest rates for future guidance on the stock market? An interesting point made by Buffett in 1999:

"look at one of the two important variables that affect investment results: interest rates. These act on financial valuations the way gravity acts on matter: The higher the rate, the greater the downward pull. That's because the rates of return that investors need from any kind of investment are directly tied to the risk-free rate that they can earn from government securities. So if the government rate rises, the prices of all other investments must adjust downward, to a level that brings their expected rates of return into line. Conversely, if government interest rates fall, the move pushes the prices of all other investments upward. The basic proposition is this: What an investor should pay today for a dollar to be received tomorrow can only be determined by first looking at the risk-free interest rate.

Thursday 9 January 2014

'To Catch A Trader' - Insider trading documentary on SAC Capital

'To Catch A Trader' - Insider trading documentary on SAC Capital

Just watched a free documentary on PBS about SAC Capital and insider trading

Interesting view on Steve Cohen's track record: http://en.wikipedia.org/wiki/Steven_A._Cohen

Some interesting parts:

- a trader Turney Duff talks about gathering information from his network of sources

- was the first time I had heard about the use of 'expert network firms'

- Fairfax Financial vs SAC Capital and Jim Chanos's Kynikos and alleging collusion with research analysts to drive down FFH stock

Here is the link to the documentary online:

http://www.pbs.org/wgbh/pages/frontline/to-catch-a-trader/

Thanks to CS Investing for their great blog and pointing out this documentary.

Friday 3 January 2014

Teledyne and Dr Henry Singleton

Been a while since the last post and will keep this one short.

Just finished a case study of Teledyne founder and supreme capital allocator Dr Henry Singleton.

For those interested in learning about who Warren Buffett believed to have amongst the best operating and capital deployment record in American business history I would highly recommend downloading the case study here:

http://csinvesting.org/2011/09/20/henry-singleton-and-teledyne-a-study-in-excellent-capital-allocation/

or here:

http://www.scribd.com/doc/65650082/Teledyne-and-Henry-Singleton-a-CS-of-a-Great-Capital-Allocator

Thanks to the CS Investing blog and John Chew for the great work in putting this together.